Many European auto insurers overlook a critical risk component

Many European auto insurers are overlooking a critical dynamic that influences the risks they insure, effectively missing out on a decade’s worth of technological evolution crucial for vehicle insurance

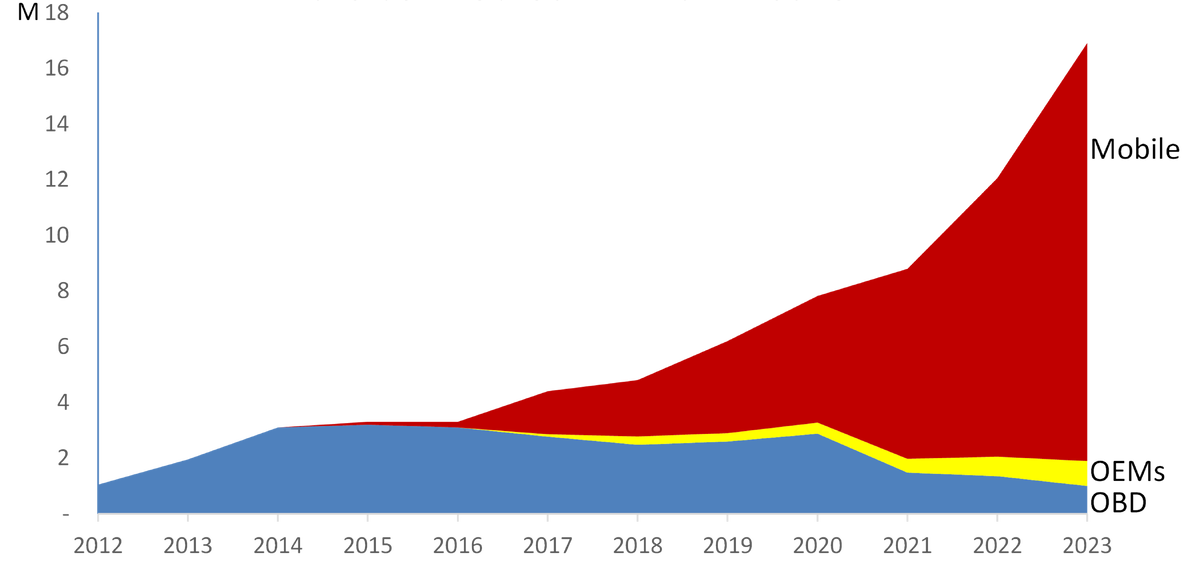

The UK and Italian insurance markets, pioneers and early adopters of telematics, represented global best practice until the early years of the 2010s. The US has since become the leading telematics market, transitioning from OBD to mobile telematics since 2018. Today, telematics is deemed essential for competitiveness in the US auto insurance market.

The broad adoption of mobile-based telematics in the US has enabled insurers to recognise the significant impact of driver distraction on the claims they pay. Traditionally, road safety studies combined observational data, self-reported behaviours, and crash and police reports. European insurers, still relying on these analogue data sources, tend to underestimate or intentionally overlook the real effects of distraction on the risks they cover.

Telematics data from CMT, the world’s largest telematics service provider, which covers 21 of the top 25 auto carriers in the US and 26 European insurers, now allows for the study of driving behaviours on a large scale, continuously, and in near real-time. CMT’s recent findings underscore the worsening distraction epidemic and the pivotal role of user engagement in telematics programs in reducing road risk. It was observed that the riskiest drivers, when highly engaged, reduced their likelihood of being involved in an incident with a bodily injury claim by 5.5 per cent.

The study tracked 100,000 drivers in usage-based insurance programs in the US over three months, with 20 per cent classified as the riskiest drivers. Engagement was determined by the frequency of interactions with the insurance telematics app. It was found that 12 per cent of drivers were highly engaged, opening the app more than 20 times in a four-week period. The study then assessed various risky driving behaviours comparing individuals with a similar mileage driven.

Among the riskiest drivers, the most engaged showed significant improvements in driving performance, including a 20 per cent reduction in distracted driving, a 9 per cent decrease in hard braking and a 27 per cent reduction in speeding from the first to the third month. The full study is available here.

The success stories in using mobile-based telematics for risk reduction is not confined to the US. Many of CMT’s partners have begun to implement a real-time approach to mitigate risky situations, known as “real-time coaching”. This tool interacts with policyholders while driving, issuing a loud sound alert through the app at each instance of harsh braking. If the phone is connected to the car via Bluetooth, the alert is played through the car speakers.

Efficiently measuring the coaching’s impact involved setting up control and treatment groups. Within four weeks, partners observed a 20 per cent average reduction in hard braking in the treatment group (up to 30 per cent) compared with a control group not exposed to real-time coaching. This real-time risk mitigation reflected an eight-point lift in CMT’s actuarially validated risk score for the pool, with a notable 30 per cent reduction in dangerous last-minute braking among the worst segment of drivers.

Many European insurers have yet to adopt mobile-based telematics or have only small portfolios. This has led to a rationalisation gap concerning the distraction issue and a decade of delay in developing capabilities to mitigate policyholders’ risky driving behaviours through structured behavioural change programs and real-time alerts.

It is crucial for European markets to bridge this gap and align with the most advanced international auto insurance markets.

by Matteo Carbone, Founder, The IoT Insurance Observatory; Thomas Hallauer, Director of European Marketing, Cambridge Mobile Telematics

Business Reporter Team

Most Viewed

23-29 Hendon Lane, London, N3 1RT

23-29 Hendon Lane, London, N3 1RT

020 8349 4363

© 2024, Lyonsdown Limited. Business Reporter® is a registered trademark of Lyonsdown Ltd. VAT registration number: 830519543