Why finance leaders are turning to Agentic AI

CFOs that can no longer afford to drown in fragmented tools or wait for workflows that crack under pressure are turning to a new generation of AI, explains Rob Harvey at Sidetrade, who says their next hire isn’t human, it’s an AI agent

Over one in 10 enterprise CFOs are already piloting agentic AI, according to PYMNTS’ recent CAIO Report, signalling a shift in how finance leaders manage planning, operations, and decision-making.

In fact, instead of relying solely on spreadsheets and fragmented tools, many are now turning to a new kind of teammate in the finance department. Powered by agentic AI, AI agents actively collaborate with finance teams, learn from outcomes, and execute autonomously.

The end of “digital overload”

Finance teams at billion-dollar enterprises are suffocating under tech sprawl. In the UK alone, 52% of financial decision-makers say they are “stuck in digital overload,” juggling an average of seven incompatible systems—a productivity drain equivalent to 120 hours per year.

Layered onto this complexity is a relentless pressure to do much more with far less: leaner teams, rising cost of capital, increasingly complex tech stacks, and cash tied up in receivables. This pressure to unlock cash faster means teams are constantly firefighting - chasing late payments and reconciling data manually, as well as working across siloed platforms.

Automation, RPA scripts, chatbots, and digital assistants have helped with efficiency, but they’ve failed at resilience. And that’s because most automation still relies on static workflows and human-in-the-loop supervision, which tends to break down when faced with any level of variability, scale, or exception-heavy processes like collections and disputes. This inevitably leads to delays, and every delay risks missed cash, strained liquidity, and blind spots in cash flow; something CFOs can’t continue grappling with in the current economy.

Agentic AI changes the equation

With a clear need to act fast with consistency, CFOs and finance teams are turning to a new form of AI, one that removes the need for constant supervision, manual interventions and time-wasting tool-switching.

Unlike traditional workflow automation, which follows rigid rules, or generative AI, which responds to prompts, agentic AI operates with autonomy. It reacts and adapts to change in real time and actively pursues defined goals, meaning it can make decisions and execute tasks across complex portfolios without waiting for human direction.

In this way, agentic AI functions more like a digital co-worker or orchestrator, coordinating multiple tasks across multiple systems to drive end-to-end outcomes.

Although it’s only begun to surface in the last year or so, agentic AI is already starting to transform finance operations, from managing spend and approvals to accelerating collections and cash flow.

The possibilities within Order-to-Cash

One area where it’s already proving particularly valuable is Order-to-Cash (O2C) - a function historically burdened by manual follow-ups, exception-heavy processes, and fragmented systems.

Whether it’s assessing credit risk, managing disputes, reconciling payments, uploading customer invoices, or making outbound calls, Agentic AI-powered O2C (also known as autonomous AI Agents) are able to offer:

- Autonomous outbound calling: Able to make 1,000s of personalised calls per day, speaking with customers in their preferred language, not only can it initiate first contact and follow up, but it can also adapt tone and strategy in real-time, and escalate only when strategic risk is detected. This basically means every single customer can get a call about their invoices.

- Payment automation: It can identify missing remittance or payment allocation details and provide matching information. And because payment auto-matching has become so accurate, businesses no longer need to focus on match rate metrics.

- Promise-to-pay tracking: As well as logging outcomes, it’s able to ensure every collector protocol is followed precisely, every time, down to capturing wire confirmation and payment dates.

- Inbound customer emails: Alongside understanding sentiment and detecting what a customer email regards, it can also categorise issues into dispute reason codes, auto-respond where safe to do so, and initiate escalation workflows when necessary.

A new CFO mindset

The above examples certainly sound compelling, but adoption still faces a significant barrier: mindset. For many finance professionals, the fear of being replaced lingers. But if automation replaced clerical labour, agentic AI is redefining management itself. Finance professionals are not being erased but elevated. Their role shifts towards exception handling, negotiation, and strategic interpretation of AI-driven outcomes.

Tomorrow’s finance leaders will no longer oversee AI. They will collaborate with it, negotiating terms, optimising cash flow in real time, and anticipating risks before they materialise.

This demands new skills: data fluency, orchestration, and the ability to trust machines with execution. The CFO of the near future won’t be the one monitoring dashboards, but the one designing which outcomes to delegate to agents and knowing when to step in.

This will free finance talent from repetitive follow-ups, leading to a range of impressive benefits, including significantly fewer manual interventions and full coverage of long-tail accounts without increasing headcount. The increased coverage contributes directly to the financial results, with key indicators like DSO ultimately benefiting, while finance professionals themselves are allowed the time and capacity to focus on what matters most: relationships, risk scenarios, and strategic direction.

Top five success factors for agentic AI adoption

For those keen to begin the journey into implementing an agentic AI solution, there a number of priorities to consider first, such as:

- Data quality: Agentic AI is not able to make decisions with precision without clean, structured, and contextual data, in the same way that human-based systems do, meaning data quality is key.

- Integration readiness: Building your own agents opens challenges when it comes to data access and integration with your FinTech stack. Consider embedded, purpose-built Agentic AI in dedicated O2C platforms to overcome these obstacles and deliver a return on investment (ROI).

- Change management: Anytime we introduce autonomy, we redefine trust. By this, I mean finance leaders must be ready to let go of micro-control and instead orchestrate teams around exception management and strategic oversight.

- Security and governance: Make sure the system runs on infrastructure that meets recognised standards like ISO and SOC, so you can maintain control over your data and stay compliant.

- Delegating defined outcomes: Instead of approaching agentic AI like another tool or a feature, treat it like a co-worker. More specifically, define the outcomes you want to delegate, whether that’s collections, disputes or matching, and pair them with clear rules, real data, and the right agent.

Timing is also key. Global AI adoption is accelerating at a 34% CAGR, pushing the market toward $2.4 trillion by 2032. Within three years, agentic systems are expected to be embedded across Fortune 500 finance departments. At stake is not efficiency, but competitiveness.

The CFO’s choice

For finance leaders, the question is no longer whether AI belongs in the function. It is whether they will seize the chance to collaborate with a new class of AI coworkers or fall behind rivals who already are.

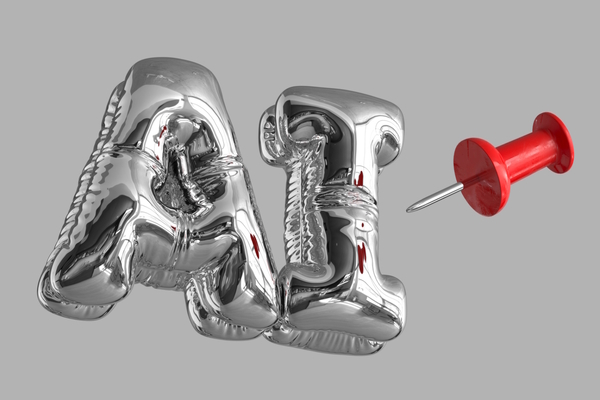

Agentic AI is not decoration. It is transformation. And for CFOs staring down volatile markets, fragile liquidity, and fractured tech stacks, it may be the only way towards quicker access to cash, less time lost to operational friction, and more room to focus on strategic priorities. The winners of tomorrow will be those who most rapidly integrate the agentic AI revolution. Those who master the orchestration of multiple specialised agents will build the financial empires of tomorrow.

Rob Harvey is Chief Product Officer at Sidetrade

Main image courtesy of iStockPhoto.com and primeimages

Business Reporter Team

Most Viewed

Winston House, 3rd Floor, Units 306-309, 2-4 Dollis Park, London, N3 1HF

23-29 Hendon Lane, London, N3 1RT

020 8349 4363

© 2025, Lyonsdown Limited. Business Reporter® is a registered trademark of Lyonsdown Ltd. VAT registration number: 830519543