The top automation trends in the insurance industry for 2022

In the search for a personalised experience, consumers are forcing insurers to adapt to their demands

Thanks to technology, we’re all used to speed and personalisation in our personal and professional lives. When a fast food app can greet you by name and ask if you want your favourite meal again, you expect that kind of customer experience from every company.

The insurance industry should offer the best possible customer service and the most personalised experience. After all, it deals with the most important parts of our lives, from health to safety to our family’s futures. And it’s all possible through AI-based automation, from machine learning (making predictions based on data and learned experiences) to deep learning (using non-linear algorithms to model abstract relationships in historical data). So what are the trends in automation coming up for 2022 and how is insurance going to look different at the end of the year?

Incorporating individual preferences

The most obvious trend driving the insurance industry that benefits from automation is consumer personalisation. From shopping to entertainment, our expectations for personalised experiences have changed. Customers want speed, customisation and recognition of personal preferences, and insurers can actively meet their demand for individualism.

Insurers can’t afford to lag behind. According to Policy Advice, nearly 90 per cent of consumers want more personalised insurance products and policies. And, according to a JD Power survey, more than one-third of consumers say they’re interested in usage-based car insurance (using technology to track driving habits and adjusts accordingly). The volume of customer interactions already using that technology has doubled.

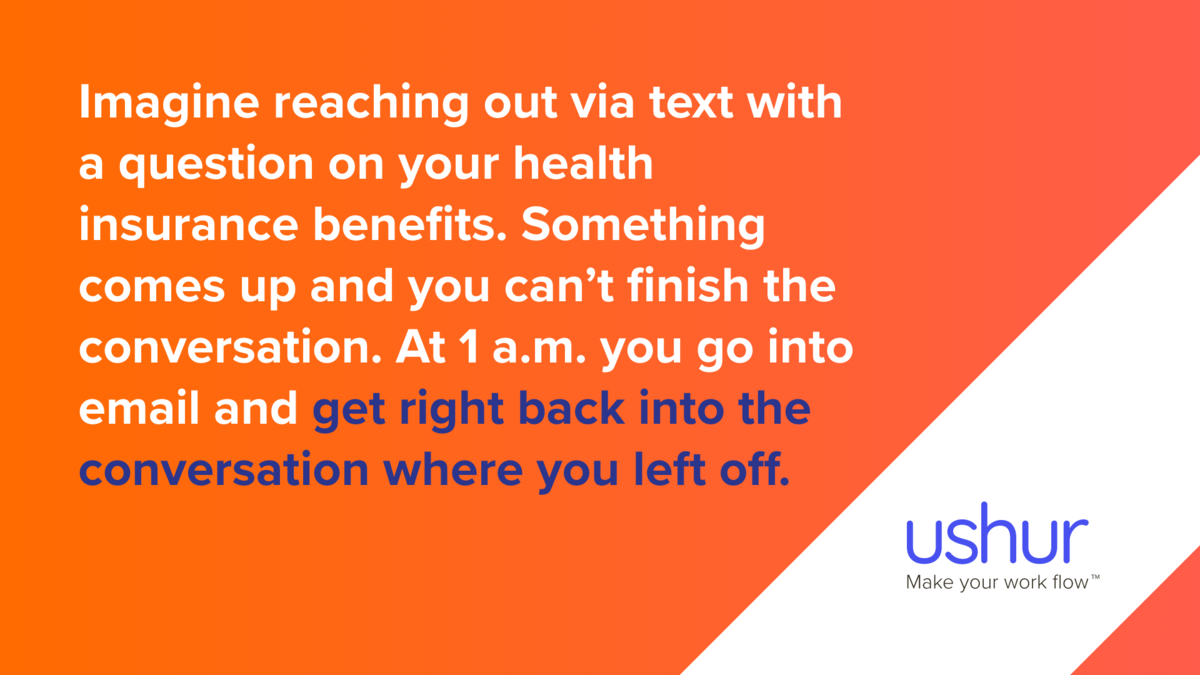

Channel switching is another common expectation from customers looking for individualized service and flexibility. Insurers predict the volume of inbound communication will increase substantially, and nearly two-thirds of consumers want to communicate using a variety of digital options – not by making a phone call. That means the insurance company has to have a platform to offer a unified experience.

Experts estimate there’ll be up to 1 trillion connected devices by 2025. This means devices in our everyday lives continually learn more about us, our preferences and our surroundings. Of all the industries leveraging that data with data science to build powerful AI, insurance is one ripe to benefit most by connecting data to products, claims and customer service.

Optimising operational efficiencies

The insurance industry is moving into a digital-first economy with successful firms quickly optimising their operations and making them more efficient. While AI can’t (and shouldn’t) replace human connection and intuition, there’s no denying that AI’s ability to find, digest and analyse huge amounts of data far exceeds most teams of analysts. That capability translates to a number of big business benefits.

- Better pricing. Working with large pools of data allows for very specific solutions that save time and reduce the margin of error from prices that don’t line up with costs. For example, a home insurance company could use AI to quickly analyse geographical location, marital status and other factors to come up with pricing very specific to that person and that house. In effect, using data instead of intuition as a guide allows for very specific offerings and lets insurance companies develop them more quickly than a purely manual effort.

- Faster response time/higher response rate. Insurance companies are investing in AI-enabled systems to crunch and learn from claims data more quickly than human beings and boost customer satisfaction. From a bottom-line perspective, that means companies will be processing more claims, faster and more accurately. All of this increases volume throughput (without necessarily increasing staffing costs) and reduces waste in the claims processes.

- Increase employee engagement/reduce turnover. No matter what the form of automation, it reduces and in some cases eliminates rote work from employees’ daily responsibilities. If you look at a call centre as one example, customer service agents won’t have to deal with the same query over and over again, especially when it’s a simple question. Automation takes the ‘blah’ out of business and replaces it with employee engagement.

Insurance agencies will use artificial intelligence to boost their bottom lines, market share and operational efficiencies in 2022.

Integrating with ease

Organisations are going to take sophisticated artificial intelligence and easily integrate it into their automation flows in 2022, especially when organisations are able to apply AI intentionally and narrowly. With AI embedded into their capabilities, low-code/no-code platforms provide a win-win for the IT team, the organisation and the users (both customers and brokers/agents who have to adapt to new tools).

And while insurance carriers have lagged behind other industries such as retail, one of the benefits of investing in AI-based solutions later is that the insurance sector is learning from other industries, reducing the time and cost of integration and adoption. Insurers will continue to seek and onboard SaaS solutions with enterprise-grade SDKs and powerful APIs to support modernisation efforts alongside their existing technological investments.

The benefits outweigh the costs

Change is hard. Adopting new technology that also changes how you work can be even harder. Customer service representatives may have to learn new roles. Brokers and agents may need to adopt different ways of interacting with customers. None of those changes are fixed overnight.

There is both a tangible and an intangible cost to adopting AI-driven tools and technologies. But the benefits of AI are so clear to both the company and the consumer, and the pace of adopting AI is going to be so fast in 2022, that it’s critical to embrace that change for everyone’s benefit.

To find out more, visit ushur.com

by William Roberts, Senior Product Marketing Manager and Meredith Barnes-Cook, Global Head of Insurance & Industries, Ushur

Business Reporter Team

Most Viewed

Winston House, 3rd Floor, Units 306-309, 2-4 Dollis Park, London, N3 1HF

23-29 Hendon Lane, London, N3 1RT

020 8349 4363

© 2025, Lyonsdown Limited. Business Reporter® is a registered trademark of Lyonsdown Ltd. VAT registration number: 830519543