The hidden tax ID compliance failure costing global companies millions

Sponsored by FonoaA $9 million gap is just one symptom of a frontline compliance failure impacting tax, cashflow and revenue recognition

A leading global SaaS provider, one of the world’s top 50 software companies, recently discovered that roughly 10 per cent of its customer tax IDs were either missing or invalid. The exposure: more than $9 million in potential annual VAT shortfalls, plus mounting audit liability across multiple jurisdictions.

They’re not alone. Organisations that fail to get this right face serious financial and operational consequences. When e-invoices are rejected by tax authorities or recipients because of invalid tax data, customers don’t pay until it’s corrected and cashflow takes the hit. Add faulty tax calculations on transactions and failed VAT recovery claims, and finance teams soon find themselves buried in corrections that could have been prevented. And with digital transaction reporting and e-invoicing becoming the norm globally, it is a growing problem.

If you haven’t reviewed your internal tax ID capture and validation processes recently, now is the time. But the challenge is that although validation sounds simple (check that a number exists and matches the relevant tax authority’s records), in practice, it’s anything but.

The problem no one talks about

Five years ago, tax ID validation wasn’t a priority for most businesses. Most transactions were domestic, with VAT applied regardless, and cross-border trade was primarily the domain of large enterprises with established processes. Format checks to ensure numbers matched expected patterns were often considered sufficient.

That landscape has changed. The e-commerce boom and globalisation that began in 2020 have significantly reshaped international trade. Cross-border transactions are now routine for companies of all sizes, making the distinction between B2B and B2C sales a much higher-stakes question. Today, invalid tax data doesn’t just create back-office headaches, it blocks transactions entirely.

Tax authorities are shifting from periodic audits to continuous transaction controls and e-invoicing. They can see your data as it flows, not months later during a review. Invalid tax IDs get flagged immediately, often before you even know there’s a problem.

Validation isn’t just about whether VAT applies; it’s about properly identifying the counterparty on every transaction to ensure compliant reporting.

Why validation is harder than it looks

The obvious solution is to check tax IDs against official databases. For companies operating within the EU, the VIES system provides this function for VAT numbers. But VIES has limitations that become apparent at scale.

It covers EU VAT numbers only, leaving businesses to find separate solutions for every other jurisdiction. It experiences downtime and delays, especially during peak traffic periods. And it provides binary responses (valid or invalid) without the additional context businesses often need.

Perhaps most importantly, VIES isn’t a complete reflection of local EU country databases. There are significant gaps in business IDs, such as:

- France: 12 per cent

- Italy: 17 per cent

- Portugal: 61 per cent

- Poland: 13 per cent

Logically, large enterprises operating across dozens of countries quickly outgrow what VIES can offer. They need validation across multiple tax types, jurisdictions and registration systems. They need it integrated into their workflows, not as a separate manual check. And they need it fast enough to not slow down customer onboarding or transaction processing.

This creates a gap. Businesses know validation matters, but the infrastructure to do it well across global operations hasn’t been readily available.

The revalidation question

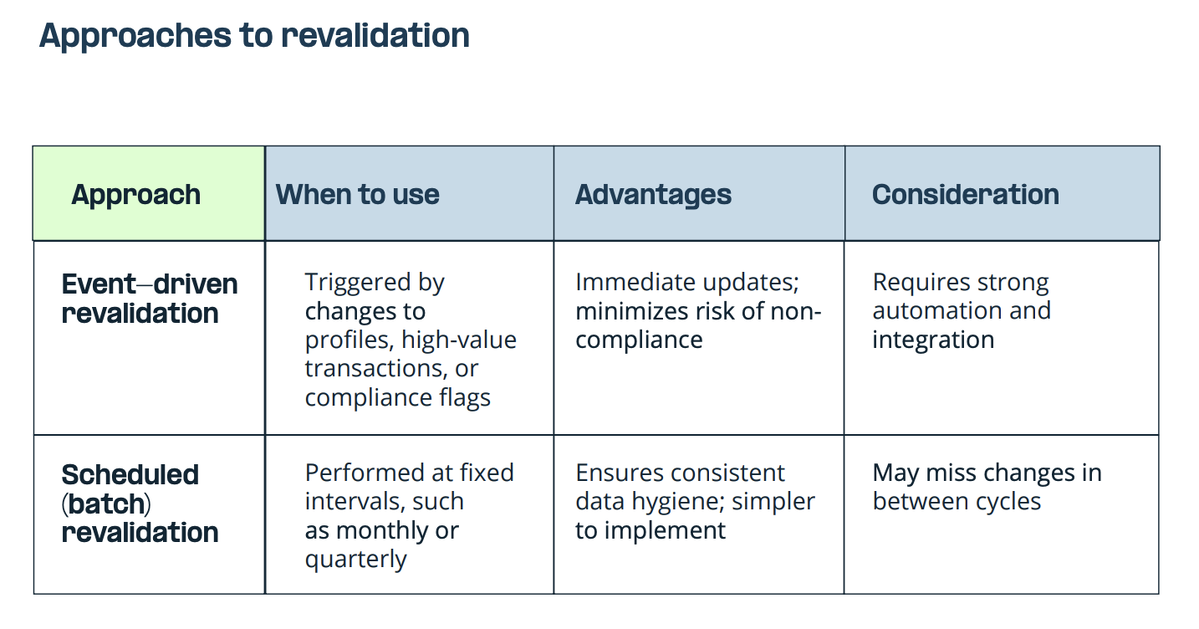

Even companies with robust initial tax ID validation face a second challenge: how often should you revalidate?

A customer’s tax ID was valid when they signed up three years ago. Is it still valid today? According to Fonoa’s data, anywhere from 10 to 20 per cent of business IDs change in just one year. That’s because companies change registration status. Businesses merge, restructure or cease operations. Tax authorities update their records.

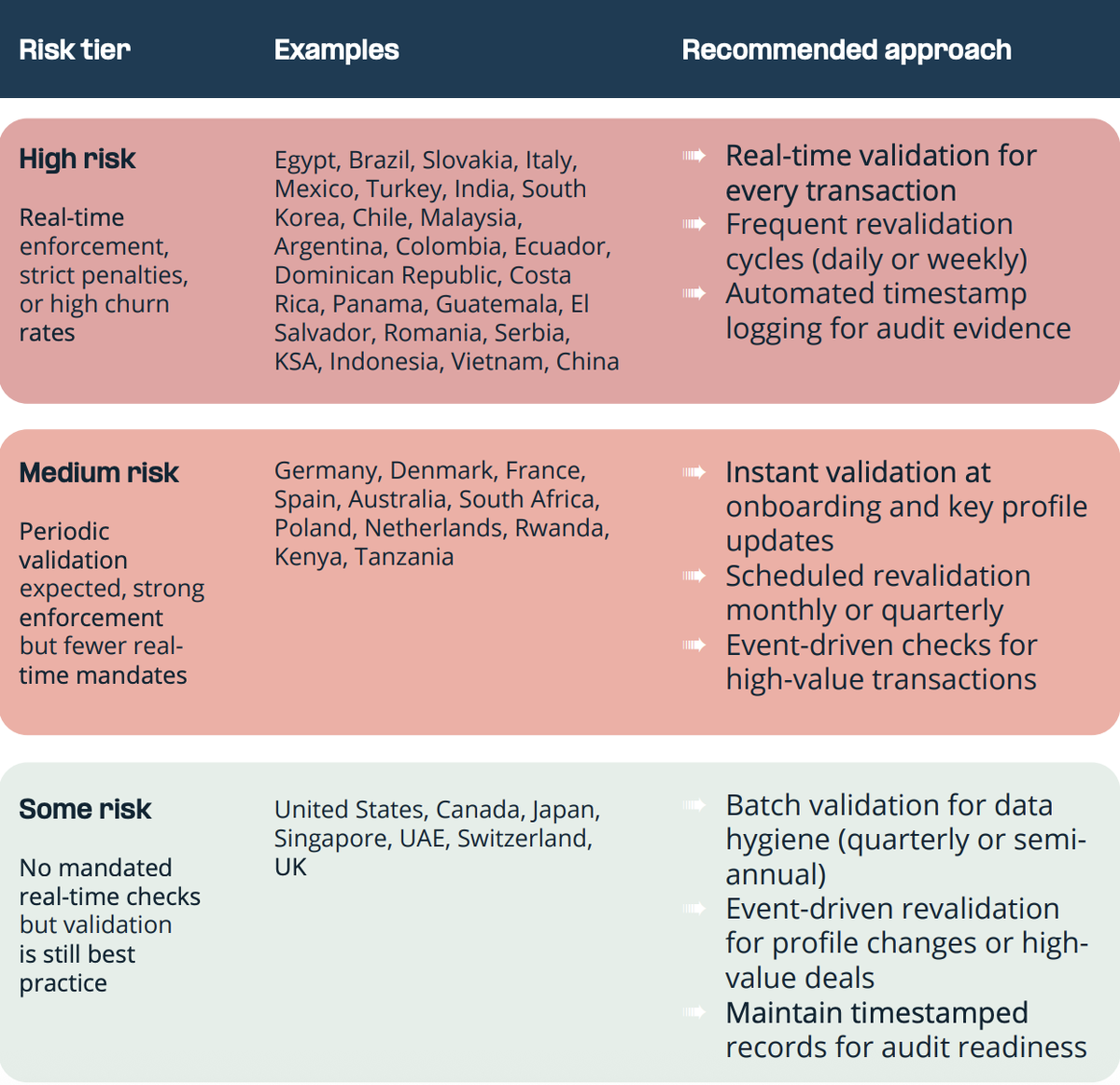

There’s no universal answer to how frequently tax IDs should be validated. In our discussions with tax authorities across more than 20 jurisdictions, the guidance varied enormously. Slovakia requires verification for every transaction. France recommends quarterly or monthly checks depending on transaction frequency. Norway expects verification when each invoice is received. Jamaica leaves frequency entirely to business discretion, with the burden and risk of being correct resting with the business.

For multi-country operations, this creates conflicting requirements. A revalidation approach that satisfies one jurisdiction may fall short in another. Manual tracking across different timelines isn’t sustainable.

From reconciliation to prevention

The shift happening now is from treating tax ID issues as reconciliation problems to treating them as business-critical prevention opportunities.

When validation happens at the point of entry, integrated into onboarding and transaction workflows, bad data never enters your systems. Errors that would have taken hours to fix downstream are caught in seconds. Finance teams stop spending time on costly corrections downstream.

One logistics company processing thousands of tax IDs annually across more than 30 countries reduced customer onboarding time from seven hours to under five minutes by automating validation. The same process caught 18 per cent of tax IDs as invalid at the point of collection. Those were errors that would have created weeks of reconciliation work had they made it into the system.

The financial impact extends beyond operational efficiency. Faster onboarding accelerates revenue recognition. Accurate tax data protects VAT recovery. Clean records reduce audit exposure.

What good validation looks like

Effective tax ID validation requires real-time access to official tax authority databases across every jurisdiction you operate in. It requires integration into existing workflows so validation happens automatically, not as a manual step someone might skip. It requires scheduled revalidation based on each jurisdiction’s requirements, not a one-time check.

Most importantly, it requires treating tax data quality as foundational infrastructure rather than an afterthought.

The companies getting this right, some of the largest in the world, aren’t building custom solutions for each country. They’re using platforms that aggregate access to global tax authority data and embed validation into their existing systems.

As tax regimes continue moving towards real-time compliance, the businesses with clean, validated tax data will have a structural advantage. Those still running manual processes will spend significant time and resources fixing problems that shouldn’t have occurred in the first place.

To learn more about implementing tax ID validation across your operations, check out Fonoa Lookup, the global tax ID validation solution for modern enterprise.

By Rob van der Woude, Chief Tax Officer, Fonoa

Business Reporter Team

Most Viewed

Winston House, 3rd Floor, Units 306-309, 2-4 Dollis Park, London, N3 1HF

23-29 Hendon Lane, London, N3 1RT

020 8349 4363

© 2025, Lyonsdown Limited. Business Reporter® is a registered trademark of Lyonsdown Ltd. VAT registration number: 830519543